So your personal finances are a bit all over the place. That’s understandable and all too common.

Up until now you probably thought you had three options:

Option 1: Pay a fortune to see a financial adviser

Option 2: Buy a pack of paracetamol and try do it yourself

Option 3: Forget about it

Good news!

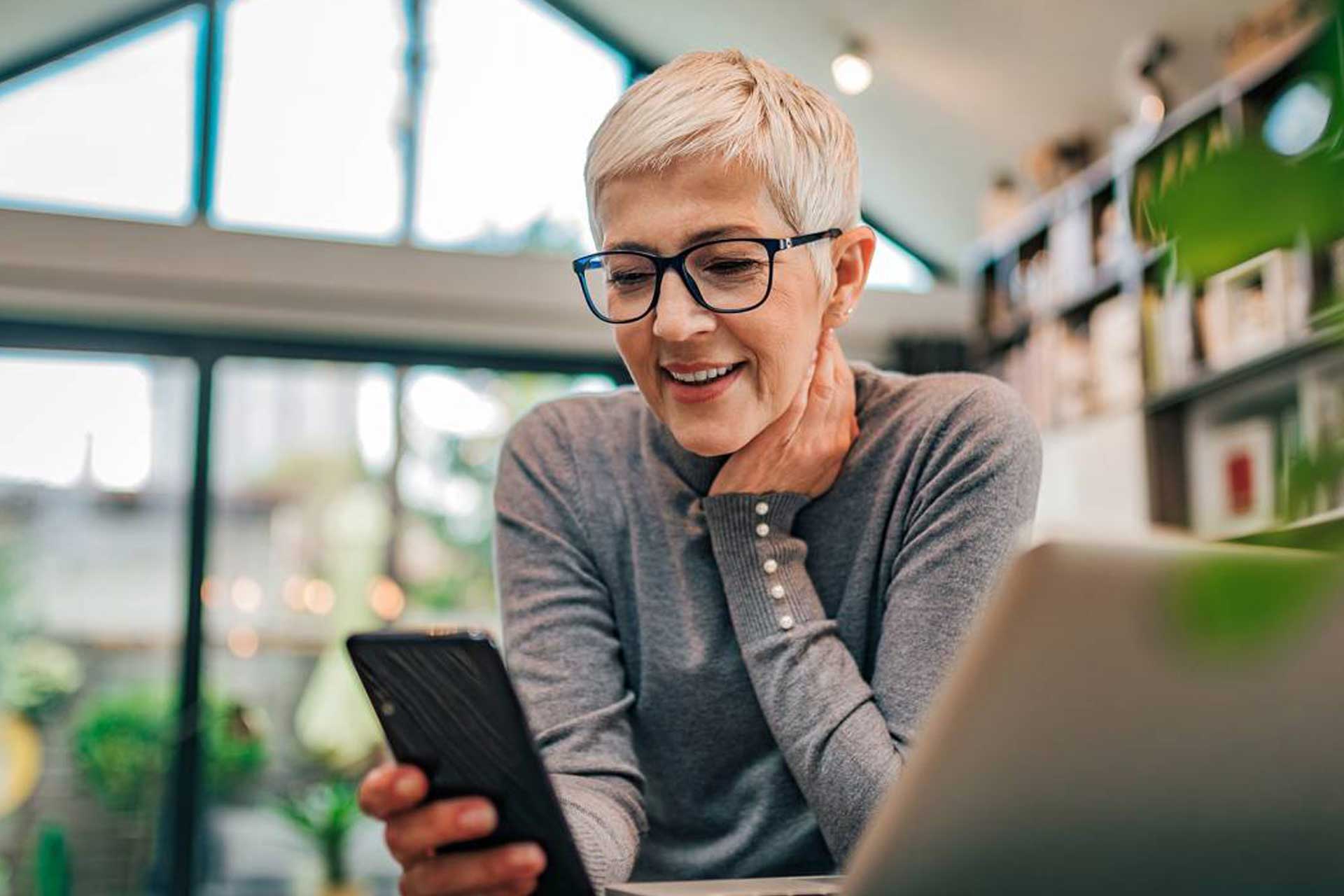

There is an option 4: Access an online toolkit with support from a financial wiz when you need it. Our hybrid solution means you’re in the driver’s seat but you have an expert co-pilot you can turn to. It also means you can sort out one issue, like your super, or get stuck into the whole shebang.

It’s simple. It’s affordable. And it’s all about you and your specific needs. Tick, tick and tick.

Process makes perfect

Taking charge of your finances doesn’t have to be complicated and expensive. It’s all about figuring out what you need and what you could be doing better.

We’ll kick off with a quick online questionnaire then recommend the best course of action. That could be a quick overhaul of one finance issue. Or it could be a comprehensive Spindle Plan with the option of ongoing support. The one guarantee is you’ll feel more calm, confident and in control.

What you'll get

- Modern and automated platforms that save time and get sh!t done.

- Access to a down-to-earth, experienced financial expert and loan consultant when you need it.

- Language you can understand (we don't speak finance, we speak human).

- A balanced view - saving is great but you've gotta enjoy life too.

- Transparent one-off fees and affordable packages that cater to your specific needs.

- Non-biased advice because we're not linked to an institution.

What you definitely won't get

- A stuffy bank or institution (we're more casual shorts than flashy suits).

- Jargon that requires an interpreter and a double shot.

- Judgement about your spending habits and bank/super balance.

- Elitist attitude that fobs off the not-wealthy or not-wealthy yet.

- Sleazy sales tactics and upselling (you know what you need, you don't need pressure).

- Advice based on the highest commission we can get from a specific institution.

Our Services

The financial sh!t we can help you sort out

We get it, the mere mention of super makes you yawn and change the subject. But give it a little TLC now and you’ll reap the rewards later.

- Super health check

- Super advice

- Consolidation

- Roll over

Life is full of curveballs so you need a sturdy shield. We can help you pick the right cover minus the sky high premiums.

- New policy set-up

- Insurance health check

- Insurance advice

Don’t take investment advice from your aunt’s step-cousin’s clairvoyant. We can help you make better decisions to grow your wealth.

- Portfolio set-up

- Portfolio health check

- Investment advice and risk management

Managing your super fund doesn’t have to be a stressful part-time job. From buying property to staying compliant, we’ll help you nail it.

- SMSF set-up or closure

- SMSF health check

- Property investment advice and support

- Admin, auditing and tax returns

Wills and estates can be fraught with headaches and feuds but they don’t have to be. Get organised now so your wishes are followed after your final adios.

- Will set-up

- Estate planning advice

- Discretionary trust advice and support

So many lenders, so much fine print, so little time. Stress not. We can help you secure the ideal loan for your home, car or other personal purchase.

- Home loans

- Car loans

- Personal loan